10 Simple Methods to Learn/Start Stock Market Trading (India) in 2023

- Profile Traders

- Jan 30, 2021

- 12 min read

Updated: Aug 21, 2023

The most significant advantage of stock market trading is you are the boss of your business, and you can work from anywhere and anytime. Because of these reasons, many youths and working professionals start checking Sensex and bank nifty live in the morning session of the market every day.

The market rewards only the dedicated people, and it punishes all the people who don’t have discipline with their trading. Hence, it is better to explore all the aspects of the share market before taking serious bets.

What is Stock Market Trading?

Stock Market Trading is all about buying and selling shares of publicly listed companies. Some popular stocks in India are HDFC Bank (HDFC), Reliance, TCS, Infosys, SBI Bank, ITC, etc.

Some of the popular stocks in America are Apple (AAPL), Facebook (FB), Microsoft (MSFT), Amazon (AMZN), Google (GOOGL), Netflix (NFLX), etc.

To begin with trading, you will require a "Trading" and "Demat" account. Aadhar, pan card, and income proof documents are essential to open a Demat account in India. This account will be linked to your bank account for online money transfer.

The leading Stock Brokers in India at the moment are "Zerodha" and "Upstox." One has to open an account to start trading (the account opening process is online, and it takes only 15-30 minutes).

As an Indian Trader/Investor, the two markets that you can trade are:

National Stock Exchange (NSE)

Bombay Stock Exchange (BSE)

There are many types of trading. Some are listed below:

In this form of trading, traders buy and sell the stocks on the same day. A trader involved in day trading needs to close his transactions prior to the day’s market closure.

Day trading requires high proficiency and skill in the market. Therefore, it is performed mostly by experienced traders.

In this trading, traders hold the stocks for a few days. The basic idea is to ride the profits of one complete swing in the sideways market trend.

Positional Trading

In this trading, traders hold the stocks for a few days to weeks. The idea is to get the benefit from the major movement of the trend.

Here, traders aim to capture good moves in a short duration.

Popular Topics

If you are a beginner, below 10 simple ways are helpful to learn stock market trading.

Step-1: Read Good Stock Market Books

“A book is a dream you hold in your hands” – Neil Gaiman

Amazon has millions of books on stock market trading. A good book will deliver useful information in a simple way. Any book with 100+ reviews and an average rating above 4.0* is a good book as per Amazon standards.

Some of the famous stock market books are ‘Trading in the Zone’, ‘Market Wizards’, ‘Trade like a Casino’, etc. One can check the best top-10 books on stock market trading to elevate their skills.

When you pick up a trading book, please read it in general for the first time to understand the concepts. If the content is good, then reread it and identify the same information on the charts.

Now try to identify whether you started liking any forms of trading among price action trading, breakout trading, investment, or swing trading. If you like a concept and suit your personality, go in-depth on the same idea by reading a few more advanced books on the same topic.

One can also read my best-selling book ' How to make Money with Breakout Trading'

Step-2: Refer to Trading Blogs

Many profitable traders share useful information and their experience through their blogs. It is a good idea to read all the content and subscribe to such blogs so that you will be notified when they upload new content.

Below are some of the useful blogs on the share market:

Step-3: Finalize a Trading concept after Back Testing

“All you need is one pattern to make a living” — Linda Raschke

A person starts to learn to drive a car. In the learning process, he has two choices:

Stick to one car every day until he becomes comfortable driving the car

Try a different car every day

Which one do you suggest?

Most people suggest option-1. Isn’t it?

The reason is simple.

Every car comes with different features, and it’s nothing to do with driving skills. If you know how to drive a car, you will drive most of the cars with slight adjustment and caution. But while learning to drive a car, it is better to stick to one car.

The same logic applies to trading as well.

It is better to stick to one trading method which suits your personality. There are many trading methods like Breakout Trading, Price Action Trading, Swing Trading, etc. Hence, it is better to perform complete backtesting on one trading method for many years to have absolute clarity on the trading concept.

Any backtesting procedure should arrive at two things – 1) Success Ratio and 2) Risk-Reward

If a trading method gives a 50% success ratio and 1:2 Risk-Reward, then it is a good trading system, and in the long run, there is a higher probability to make money in trading. To know more about Success Ratio and Risk-Reward, read this post.

There are many ways to perform backtesting. One can prefer to do it manually or take the help of a software or website. Tradingview provides a simple way to perform the backtesting.

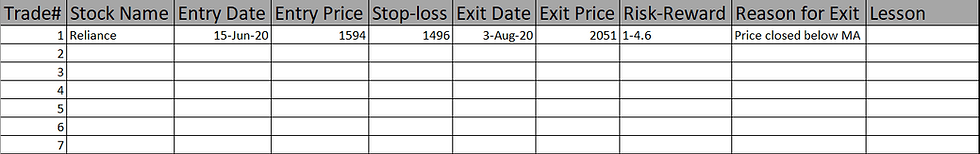

A trader can use the below template for manual backtesting. In the end, log all the identified trades and calculate the success ratio and risk-reward (by averaging).

Step-4: Pick the Right Timeframe

Many traders pick the wrong timeframe because of a lack of knowledge or eagerness to make quick money.

For example, a person who doesn't have an investment attitude (no intention to hold the trades for many months/years) looks for a trade in monthly charts thinking higher timeframe trades give success.

It is not a good idea because he has to hold the trade for many months to exit the trade. He can't ride the complete profits as he doesn't have that mindset.

Hence, always pick the right timeframe to manage your trades. If you are an intraday trader, stick to a 15-min or 30-min chart. If you hold your trades for 1-10 days, then you can use 4-hour or daily timeframe charts. Please note opportunity exists in all the timeframe.

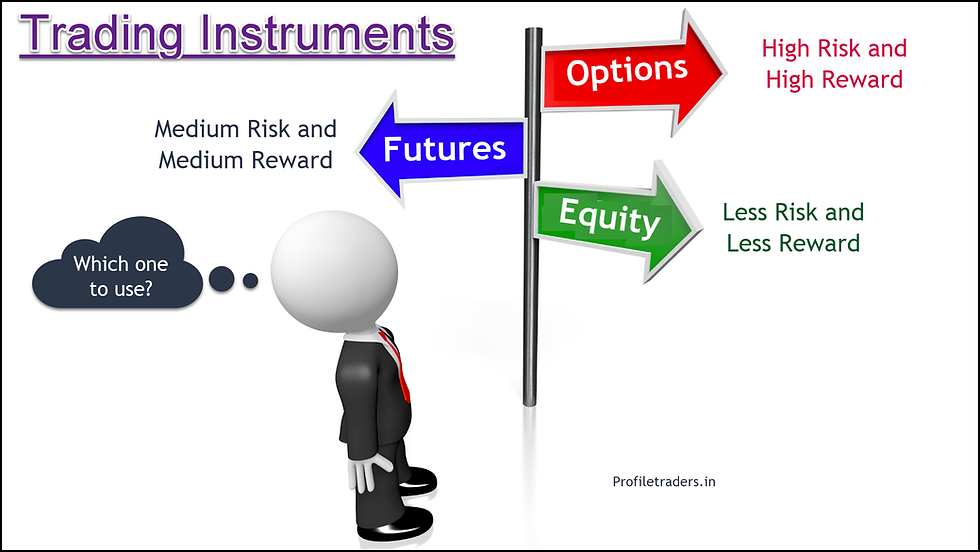

Step-5: Understand the Trading Instruments

We have below 3 trading instruments in the stock market:

1. Equity

2. Futures

3. Options

So, a trader should know how these trading instruments work.

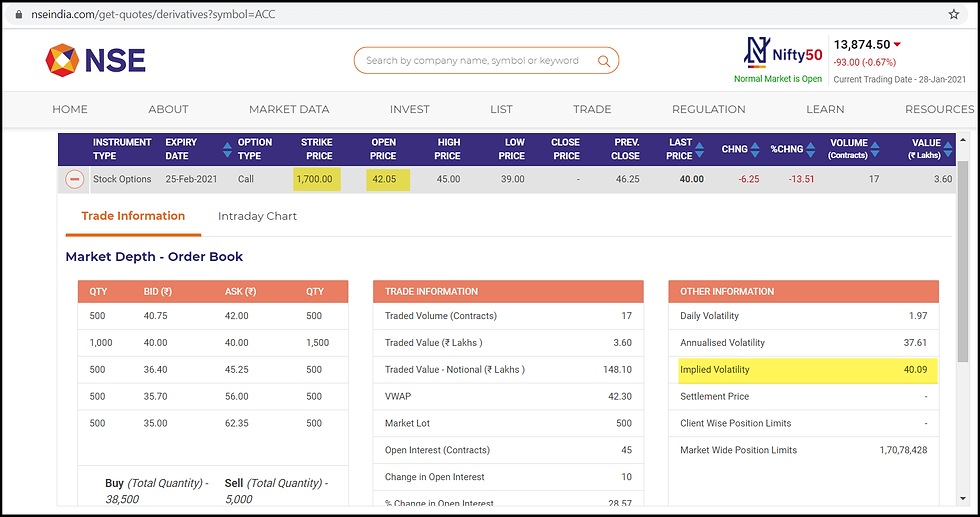

Let us take an example to understand better.

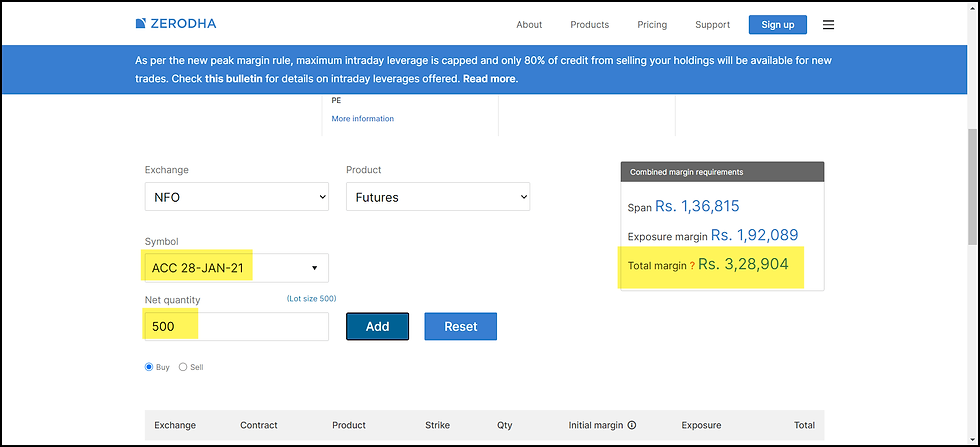

Assume one Trading Account has Rs. 3,30,000 (3.3 Lakh).

ACC Current Market Price CMP is 1620.

Assume ACC went 5% (81 points) up in the next 2 trading days. (Explanation sake)

Case-1: Equity

With 3.30 lakh, one can buy 203 shares.

Profit made due to 5% upside movement is Rs.16,443 (203 shares X 81 points)

ROI on Capital is 5%

Case-2: Futures

With 3.30 lakh, a trader can buy 1 lot (500 shares).

Profit made due to 5% upside movement is Rs. 40,500 (500 QTY X 81)

ROI on capital is 12%

Case-3: Options

With 3.30 lakh, one can buy 7500 QTY of 1700 CE of ACC.

Profit made due to 5% upside movement is Rs. 2,43,000 approx (IV at 40%)

ROI on Capital is 74%

ROI varies drastically in all the 3 trading instruments.

Please note this explanation is not intended to encourage trading in options. F&O trading carries the highest risk levels, and the above description gives an overview of how the three trading instruments work by offering different degrees of risk and reward.

Step-6: Follow Successful Traders on Twitter

There are many successful traders who share their views and analysis every day live on Twitter. Hence, it is better to follow them and get the knowledge every day.

Below are some of the successful traders who love to share their knowledge:

N S Fidai

Nooresh Merani

Step-7: Register for Stock Market Online Courses

Covid-19 has changed our lives forever. There is no doubt that it has taken many lives and also impacted many people emotionally and financially. However, the other side of the story is it provided an opportunity to learn from anyone in any part of the world at a throwaway price.

Earlier traders were traveling across cities to attend the stock market courses. However, one can attend the online course from their home credit to Zoom and other online platforms.

Besides, many online courses are available for FREE or at a significantly less price. One can check the below courses:

The Price Action Trading Strategy Guide – Rs. 998 only

Intraday Trading Online Course – Rs. 1998 only

Step-8: Find a Mentor

Many people isolate themselves, and they try to learn to trade on their own. They spend many weeks and months decoding the mysteries of trading.

But only a mentor can provide crucial feedback at the right time. Besides, a mentor will also accelerate the learning process.

Some people think that they don’t need mentors. However, a mentor plays a significant role at all stages in trading. A good mentor challenges the way you think, as they have seen different dimensions of the market.

Mark Zuckerberg took the guidance from Steve Jobs while expanding Facebook. He also sends out a post on his Facebook page, ‘Steve, thank you for being a mentor and a friend. Thanks for showing that what you build can change the world. I will miss you.’

6 steps to find a good mentor:

It would be best if you were prepared, get out into the world, and meet people. You never know, anything can happen.

Develop a habit of interacting with experienced traders. You can find most of the traders on Twitter, and most of them will answer all the questions. You can ask their email addresses and send any follow-up questions.

Don't trust anyone who comes with a 90% accuracy trading system. Because only god and a liar can get 90% accuracy over a long time.

Don't trust anyone who displays only their MTM screenshots every time (without sharing any other concept).

Don't trust anyone who tries to sell their expensive products every time.

If you want to learn intraday trading, find a person who shares his analysis in the live market (be it failure or success). Just think to share their analysis in the live market to the whole world demands courage, and it shows their confidence. Follow such people. Because anyone can come with post-mortem analysis after market hours!

Step-9: Take a Break

“There is time to go long, time to go short, and time to go fishing.” – Jesse Livermore

Many traders anticipate action every day in the market. They want to make some trades daily even if there is no opportunity. It is a bad habit, and traders will lose a lot of money because of this bad habit.

Sometimes, the market waits for some fundamental shift, and it doesn’t give any move on both sides (up or down). During this time, it is a wise move to safeguard our capital by avoiding trades.

Besides, traders should avoid taking trades when they are too emotional (for any reason). When we are emotional, we tend to make bad decisions, which can cost a lot of money.

Do you know many people lose over 80% of their capital in 20% of the trades? It is because of the inability to accept failures and a revenge attitude. Whenever you take a loss and hurt your ego, it is better to take a break. Otherwise, you end up taking more trades (more risk) and losing a significant portion of your capital.

Step-10: Be Humble and Develop Gratitude

Most people think only technical concepts are helpful to get success in trading. However, in reality, clear money management rules and trading psychology plays a crucial role. Trading psychology refers to people’s mindset when they are managing their trades.

It is essential to stay in a good frame of mind during trading. A trader will lose money if he allows any emotion to take over him. Always remember there is no need to debate or fight with anyone over any trading idea/concepts. You are right if you are making money, and you are wrong if you are losing money. The same logic goes with any other trading concepts.

Gratitude opens the door to beautiful results. A person who is grateful for his life will be able to make better trading decisions, resulting in more profits.

If you enjoyed this article, please share it with your friends!

Why 90% of Traders Lose Money?

Over 90% of the traders lose money in stock market trading. Hence it is important to know the reasons behind it.

Here are the 5 crucial lessons every person should know/understand before they take trades in the stock market:

1 - Failure is inevitable in Stock Market Trading:

Most people have a common upbringing which develops a common thought that "failure is bad" in our mind.

It can be in high school, college, or at the job. People feel terrible whenever they get some failure because of the reactions from others. Hence they try to rectify it by passing the exam or getting a good job.

We apply the same logic unconsciously in trading and lose money. Nobody will get 80% or 90% accuracy in trading, and most successful traders will only have 40-60% accuracy in their trading.

So, when a beginner gets a failure, his subconscious mind provokes him to rectify it by taking some unnecessary trades immediately. This is called "revenge trading," and most beginners lose their entire capital because of this mistake.

Hence the first step for a beginner is to realize that failure is expected in the stock market trading, and he should not react to it. The trick is to lose less money when we fail and make more money when we succeed.

2 - Importance of Money Management:

Over 90% of the traders ignore the importance of money management.

Even if you have a 60% accurate trading system, there is a possibility of getting 8-10 failed trades in one stretch. This is called 'random distribution,' It is not related to your intelligence or trading strategy.

So if you risk 10% of your capital per trade, then when you get 8-10 failed trades in one stretch, you lose all your capital (I am sure most people commit more mistakes even if they lose only 50% of their capital).

So if you aim to survive in trading in the long run and if you are damn serious about markets, risk only 2-3% of your capital per trade. In this case, you lose only 20-30% capital even if you get 10 failed trades in one stretch.

3 - Power of One Trading System:

Bruce Lee lived only 32 years on this planet, and he created an ever-ending impact on everyone's mind. He was an expert martial artist, actor, director, story writer, producer, and philosopher. He died 50 years ago, and till today everyone remembers him.

“I fear not the man who has practiced 10,000 kicks once, but I fear the man who has practiced one kick 10,000 times.”

He always mentioned this quote whenever people asked him any question about getting success in life.

The same logic applies to stock market trading as well.

Most people get attracted by a trading idea and start taking trades on that system. But whenever they some failures, they lose the trust in that system and jump to another system.

This is a vicious cycle with traders, and most people never come out of it. So if you want to become a successful trader, pick one trading idea, go in-depth, and start taking trades only on that system.

In this process, identify all your mistakes and try to avoid those mistakes when you take the next trade.

4 - Big Profit Screenshots will NOT TEACH ANYTHING:

Most beginners look for some inspiration about trading on social media sites. But some people misuse this by displaying fake high-profit screenshots to get the attraction.

Whenever you see a big profit screenshot, ask these questions yourself:

Whether you get any technical analysis knowledge?

Whether you get any money management lessons?

Whether you get any lessons related to trading psychology?

A profit screenshot can only trigger many emotions in your mind, and you end up taking unwanted trades on any trading day. So don't get distracted by these profit screenshots and follow your trading plan.

By the way, I am not against these profit screenshots. A few traders share their trades in the live market, and they share their profit screenshots later. This is entirely acceptable. But personally, I share only my trades in the live market along with a small clue regarding my position size (small, medium, or big) and don't prefer to share the profit screenshot as it can only trigger "greed" emotions in anyone's mind.

5 - Issue with 'Employee Mindset.'

This concept is difficult to understand unless you have worked as a full-time trader for a few years.

People with a fixed mindset think that their intelligence, talents, and abilities are set in stone. They don't believe anything can change them or help them improve any traits they already have naturally. They always need some motivation (either positive or negative) to complete their tasks at the workplace.

But when it comes to trading, nobody will give the tasks to you, and you are not accountable to anyone. This freedom is dangerous for people who have an employee mindset and feel lazy or have a tough time advancing in trading.

Conclusion:

If you remember the above points and persist with your trading plan, anybody can succeed in trading.

But earning lakhs depends on many parameters like - trading strategy, individual discipline, trading instruments, etc.

Above are the most important points to get success in trading. Most beginners focus only on technical analysis (TA) and ignore the other factors.

But a table can’t stand on one leg. Hence, it is important to focus on all the factors to get success in trading!

Get the Mini Trading Guide

A 5-day email course with amazing tips on trading, different trading instruments, and how to finalize a trading system. Get a best-selling eBook and online course by signing up for free.

One of the best articles I have read sofar. It has refreshed my little known knowledge to a great extent. I have shared the article with many of my friends & group. Thanks sir. Keep us enlightened. Regards.