Reliance Jio IPO – A Masterstroke of Timing?

- Profile Traders

- Sep 16, 2025

- 9 min read

In early 2025, Reliance Jio’s planned IPO was the hottest topic on Dalal Street. Touted as “India’s biggest IPO,” analysts expected a valuation of $120–150 billion.

From retail traders to large institutions, investors lined up cash, opened fresh demat accounts, and braced for what many believed would be a record-breaking offering.

Reports forecast heavy oversubscription, with comparisons drawn to past blockbusters like DMart and Zomato. The buzz created a wave of FOMO, as everyone wanted a slice of the “Jio growth story.”

Yet by mid-2025, Reliance quietly pressed pause. The company stated that it required additional time to strengthen Jio’s fundamentals, including expanding subscribers, increasing profits, and broadening digital services. The announcement left the market guessing about timing and strategy.

Still, Jio needed cash for operations. Reliance tapped the debt market, raising $2.38 billion through asset-backed securities (ABS), supported by loan receivables from its infrastructure and telecom arms, in a deal arranged by Barclays.

Choosing ABS gave Reliance breathing room. It unlocked liquidity without diluting ownership or rushing an IPO before the business was fully primed. In effect, Reliance monetised its cash flows rather than selling equity.

So the real question is: why delay an IPO that could have raised over $120 billion, and instead settle for a temporary $2.38 billion lifeline?

Do you think Reliance’s leadership, known for its long-term vision, would pass up such an enormous opportunity without reason?

The answer is simple:

Reliance is playing for bigger stakes 💰💵💹

The delay may not be about short-term cash; instead, it could be aimed at ensuring Jio lists at a stronger moment in the market. And in the sections ahead, we’ll explore why this strategy may prove far more rewarding.

Equity vs Debt: The Ultimate Face-Off

Let’s say you are an entrepreneur and need money to keep your business running. You generally have two choices: Equity or Debt.

Equity

In equity financing, you sell a part of your business to investors in exchange for money.

Advantage: No repayment pressure; investors share both the risks and the rewards.

Disadvantage: You give up a portion of ownership and control.

Debt

In debt financing, you borrow money (typically a loan for smaller companies or bonds for larger ones) and commit to repaying it with interest.

Advantage: You retain full ownership of your company.

Disadvantage: You carry a fixed repayment burden, even if your business is going through tough times.

Which should you choose?

It depends on your business model and future prospects:

If the business is risky or unpredictable, equity may be better since investors share the risk.

If the business has stable, predictable cash flows, debt can be smarter — you keep ownership, service the loan, and let the company’s value grow in your hands.

Now you know why Reliance chose to raise funds through debt rather than pushing Jio into an IPO, because debt gives them immediate liquidity without giving up ownership or rushing into the market at a suboptimal time.

By securing cash through asset-backed securities, Reliance can keep full control, strengthen Jio’s fundamentals, and prepare for a larger, more rewarding IPO debut when the business is even stronger and global conditions are more favourable.

When Will Jio Finally Make Its IPO Debut?

At some point, Jio will have to make its IPO debut to unlock the full value of its business and raise capital for future growth, a truth that Reliance's management understands well. This is because even for great companies, the timing of an IPO is critical (to get maximum publicity and attention from the investors).

Hence, most big companies avoid going public during periods of market weakness or uncertainty, choosing instead to wait for a strong bullish phase where there is abundant liquidity and investor appetite.

This strategy could allow the company to command a premium valuation, as a strong market might absorb a large-scale offering without causing a significant drop in share price.

With recent regulatory changes by SEBI making it easier for mega-listings like Jio to debut, and with the company aiming for a potential listing in the first half of 2026, it appears that Reliance is patiently waiting for what it sees as the most opportune moment, which could increase the chances of a successful and value-maximising debut.

If Jio can grow revenue and margins over the next few quarters, a delayed IPO could fetch much higher valuations than rushing in today, — senior analyst, large brokerage.

But the Nifty 50 has not been at an all-time high for the past year and has spent most of 2025 in a bearish phase. Launching a company as large as Jio, under the banner of “India’s Biggest IPO,” would not be a wise move in such market conditions.

The Nifty is currently trading around 25,000 levels, just a step away from its all-time high of 26,277, with several factors suggesting a potential breakout.

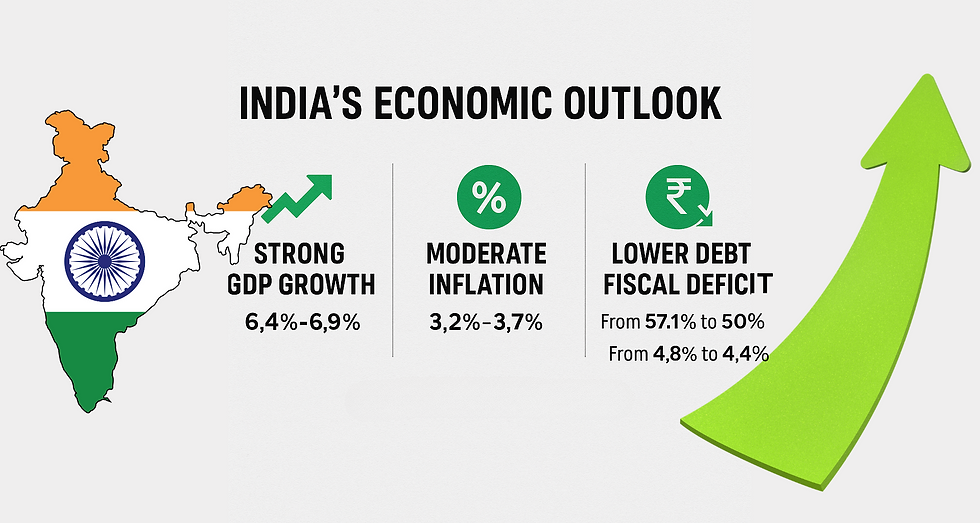

This optimism is supported by India's robust economic outlook. For fiscal year 2025-26, India's GDP growth is forecast to be strong, with projections ranging from 6.4% to 6.9%, making it one of the fastest-growing major economies. This growth is driven by strong domestic consumption and government spending.

Meanwhile, inflation is expected to remain under control, with Crisil projecting it to be around 3.2%, and the RBI forecasting it to be around 3.7%. This low-inflation environment gives the central bank room to potentially cut interest rates further, which would help stimulate the economy.

To address its debt, the Indian government has announced a new roadmap to reduce its debt-to-GDP ratio from an estimated 57.1% in FY25 to a target of around 50% by FY31. The government is also committed to reducing its fiscal deficit from 4.8% of GDP in FY25 to a targeted 4.4% in FY26.

This disciplined approach to managing its finances, coupled with the anticipated interest rate cuts by the US Federal Reserve, is expected to attract more global capital.

If ongoing trade disputes and tariff issues between India and the US are successfully resolved, it would remove a key uncertainty and could further propel the market to new record highs.

Taken together, these factors — market conditions, economic momentum, controlled inflation, fiscal consolidation, and potential foreign capital inflows provide important context for Reliance’s decision-making.

It appears that the Jio team has weighed these considerations carefully and opted to postpone its IPO debut until the first half of next year, aligning the listing with what could be a more favourable and supportive market environment.

Timing the Market: Reliance’s Fundraising Playbook

Reliance has a proven history of raising capital at just the right moment, using creative structures and strategic partners instead of rushing into public markets.

The investors are not upset (about IPO delays). They know the money is sitting in front of them. (Reuters Post)

The following milestones show how timing has always been central to its playbook.

Jio Platforms Stake Sales (2020)

It means that during the pandemic (2020), Reliance didn’t launch an IPO to raise money. Instead, it sold small ownership stakes (minority stakes) in Jio Platforms to global investors like Facebook, Google, Silver Lake, and others.

A minority stake means those companies got a percentage of ownership in Jio (without control of the company). Reliance, in return, received cash more than $20 billion in total. This deal reduced Reliance’s debt and brought in strategic partners, while Reliance still kept majority control of Jio.

Rights Issue (2020)

In 2020, Reliance raised money through a rights issue, which is when a company gives its existing shareholders the right to buy more shares at a discounted price. Reliance offered shares worth ₹53,000 crore (~$7 billion), making it the largest rights issue in India’s history.

Retail Arm Stake Sales (2020–21)

Reliance Retail also attracted investments from firms like Silver Lake, KKR, General Atlantic, and ADIA, raising around $6 billion. Again, Reliance monetised assets selectively, without immediately tapping IPO markets.

Why the World’s Biggest IPOs Waited for the Right Moment?

Global history suggests that timing is often critical in IPOs, and Reliance’s decision to hold back Jio may not be without precedent.

In India, Coal India’s 2010 IPO became the country’s largest at the time, raising over $3.5 billion by launching into a strong bull market that ensured massive oversubscription.

More recently, Zomato in 2021 went public at the peak of the post-COVID tech rally, securing huge demand despite being loss-making, purely because market sentiment was buoyant.

In the United States, Facebook waited until 2012, when its user base had exploded past 900 million and digital advertising was booming, ensuring investors were willing to pay for future growth.

China offers even bigger examples. Alibaba’s 2014 IPO in New York raised a record $25 billion, riding high on global liquidity and investor enthusiasm for Chinese tech, making it the world’s largest IPO at the time.

Years earlier, Petro China’s 2007 float came when oil prices were soaring and energy demand was peaking, briefly making it the most valuable company in the world.

The lesson across these markets is clear: great companies don’t just go public — they wait for conditions that amplify their story and maximise valuation. Reliance appears to be following the same playbook with Jio.

🔹 How This Relates to Jio?

Like Alibaba or Aramco, Jio is holding back until markets are bullish, liquidity is abundant, and the “India growth story” is in full swing. Reliance appears to be betting that a well-timed IPO could mean tens of billions in additional valuation, and its past fundraising record shows it rarely misjudges the moment.

Some More Reasons for the Smart Pause

Reliance’s decision to postpone Jio’s IPO has sparked debate across markets. But a closer look shows it is less about hesitation and more about strategy.

While patience may cost time, IPOs floated in subdued markets often leave money on the table — better to wait until investor appetite is robust — veteran investment banker.

Several factors explain why the company is waiting for the right moment:

1) Timing Matters Most in IPOs

Markets reward patience. Even the strongest companies avoid going public during downturns, choosing instead to wait for bullish conditions when liquidity is abundant and valuations can stretch further. Reliance has shown it understands this cycle well — timing is as much a strategy as the listing itself.

2) Pursuing a Premium Valuation

The delay has little to do with Jio’s operations. Reliance wants to unlock the highest possible valuation. Global volatility — from tariff disputes and currency swings to high bond yields — makes 2025 a less-than-ideal window. By 2026, if India sustains its robust growth and global rates ease, investors are likely to pay far more for the same story.

3) Bullish Markets Fuel Better Narratives

IPO valuations are not just about numbers; they are about storytelling. In bullish markets, investors pay for future growth, not just present earnings. Jio plans to present itself not merely as a telecom provider but as a digital, AI and cloud powerhouse. That pitch resonates best when investor sentiment is firmly risk-on.

4) Learning from Others’ Mistakes

The caution is not misplaced. Paytm’s 2021 listing and LIC’s 2022 debut showed how mega offerings can stumble when markets are unsettled, eroding investor confidence despite their scale. Reliance, with its reputation for long-term planning, appears unwilling to risk a repeat of such missteps.

5) Using Debt as a Strategic Bridge

In the meantime, Reliance has tapped $2.38 billion through asset-backed securities, securing growth capital without diluting equity at weaker valuations. It is a classic veteran’s move — buying time and flexibility. When market sentiment turns decisively bullish, if market conditions align, Jio’s IPO debut could be remembered as a landmark in India’s capital markets.

What if things don’t go as planned?

Reliance’s strategy looks smart on paper, but it also depends heavily on favourable conditions.

The current outlook of low inflation and strong GDP growth is optimistic, yet history shows how quickly things can change. Global shocks, policy disruptions, or even geopolitical tensions could derail India’s growth story and weaken market sentiment.

If interest rates remain high or global volatility continues, Jio may not be able to rely on debt forever. At some point, it would have no choice but to raise funds through equity, even if valuations are not at their peak. That could mean leaving money on the table, the very outcome Reliance wants to avoid.

There is also the risk of regulation and competition. Policy changes in the telecom sector could shift profitability, and rivals are not standing still. Airtel, for example, is ramping up investments in 5G expansion and digital services, which could eat into Jio’s market share and influence how investors value both companies.

In short, while Reliance’s patience may pay off, there are real risks if the perfect window for listing does not open as expected.

Risk | Favorable View | Unfavorable View |

|---|---|---|

Inflation | Crisil / RBI projections steady | Risk from food prices, oil, and global supply chain disruption |

Interest Rates | Potential repo rate cuts if inflation remains low | Could remain sticky because of global rate pressures |

Market Sentiment | Positive investor appetite for growth | Risk aversion, global shocks, competition |

Conclusion:

Reliance’s decision to delay Jio’s IPO may look puzzling at first glance, given the sheer scale of capital it could have raised. But the company’s long history of timing its moves with precision suggests this is less a retreat and more a calculated pause.

By shoring up Jio’s fundamentals, tapping interim funding through debt, and waiting for a more buoyant market, Reliance is positioning itself to capture maximum value when the window truly opens. If conditions align in 2026 for stronger growth, lower global rates, and renewed investor risk appetite, Jio’s listing could mark not just India’s biggest IPO, but also a defining moment in the country’s capital markets.

Disclaimer: This article is purely based on personal observations and publicly available information. It is not intended as investment advice or a recommendation to buy, sell, or hold any securities. Readers should conduct their own research or consult a qualified financial advisor before making investment decisions.

About the Author:

Indrazith Shantharaj is an investor, trader, and author. He is known for making finance and stock market concepts simple and practical.

He has written more than 10 best-selling books that have helped thousands of readers understand money better and move closer to financial independence.

To learn more about his work, articles, and latest updates, feel free to visit:

Comments